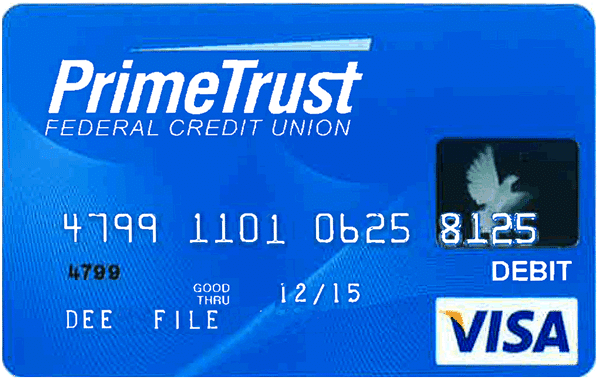

Blue Trust Premium Bank Credit Card

The Aeroplan credit card is perfect for those who want to earn miles and enjoy travel-related benefits.

Anúncios

In a world where convenience and flexibility are key, the Blue Trust Premium Bank Credit Card steps up as an option that blends modern digital services with traditional financial trust.

Blue Trust Premium Bank Credit Card

Fast online application Credit-building opportunitiesDesigned for individuals who value speed, online accessibility, and straightforward credit management, this card is gaining attention—especially among those looking for a quick financial solution without the lengthy approval delays.

While many credit cards focus on perks and points, the Blue Trust Premium Bank Credit Card aims to be a reliable financial partner that offers access to funds when you need them most.

Its application process is fully online and surprisingly fast, often delivering a decision within minutes. That’s why it’s particularly appealing to people who’ve faced challenges with credit in the past and are now trying to re-establish financial confidence.

It’s not flashy—it’s functional. And for many consumers, especially those with fair or rebuilding credit, that practicality is precisely what makes it powerful.

How the Blue Trust Premium Bank Credit Card Supports Everyday Life

The card shines in situations where traditional banks might turn you away. It was designed to provide a way forward, offering credit to those who might have been denied elsewhere. Instead of focusing on rewards, it focuses on access. And when you’re trying to build or rebuild your financial profile, that access matters more than luxury.

For example, let’s say you’ve got a car repair that just can’t wait, but your savings account is looking slim. Or maybe you need to bridge the gap between paychecks. With this card, you could get a quick credit limit with no deposit required—and the funds become available almost immediately after approval. This alone is a lifeline for many families.

Pros and Cons

Pros

- Fast online application

- Reports to major credit bureaus

- Credit-building opportunities

- No security deposit required

- Flexible repayment options

Cons

- High APR

- Monthly maintenance fee

- No rewards or points

- Limited initial credit line

- Not ideal for large purchases

Is the Blue Trust Premium Bank Credit Card Right for You?

If you’ve been rejected by major credit cards or you’re just starting to build a financial history, this card might be one of your most accessible options. It’s designed for people in transition—those moving from bad or no credit toward a stronger financial future. It’s not for someone looking for cash back, luxury perks, or travel benefits. It’s for someone who wants a second chance or a secure first step.

And it gives you that chance while also helping build your credit score. Since the card reports to all three major credit bureaus, responsible use could mean a big improvement in your credit over time. That’s the long game here: access now, better credit later.

Just remember, as with any credit product aimed at rebuilders, the cost of entry is higher. Fees and interest rates can be steep if you carry a balance. So the smartest way to use it is as a tool—keep your balances low and pay off your charges each month if possible.

Why We Recommend the Blue Trust Premium Bank Credit Card

This card is not about flashy features—it’s about providing access where others say “no.” And for thousands of Americans with fair, limited, or poor credit, that’s exactly the kind of option they’ve been searching for.

We recommend this card to individuals who are serious about rebuilding their credit and need access to funds fast. It’s a practical solution wrapped in a digital-first package. If that sounds like you, the Blue Trust Premium Bank Credit Card is worth your attention.

You will remain on this website