Blue Trust Premium Bank Credit Card – How to apply

Aeroplan Credit Card is perfect for those who want many benefits and enjoy all related advantages.

Anúncios

The Blue Trust Premium Bank Credit Card isn’t a card for luxury seekers or rewards chasers.

It was built with one clear purpose: to provide credit access and rebuild trust with consumers who’ve faced financial challenges. And in today’s lending environment, where many cards are reserved for top-tier credit holders, that mission fills a critical gap.

Unlike traditional cards that focus on flashy points systems or extravagant travel bonuses, this card operates more like a lifeline. It’s for people who’ve been told “no” one too many times by mainstream issuers. With an application process that takes minutes and no need for a security deposit, it offers a rare opportunity for users with less-than-perfect credit to get back on their feet.

At its core, the Blue Trust Premium Bank Credit Card is designed to be simple, fast, and forgiving. That means fewer hoops to jump through, less judgment based on past credit missteps, and a straightforward experience built for people trying to regain control of their financial lives.

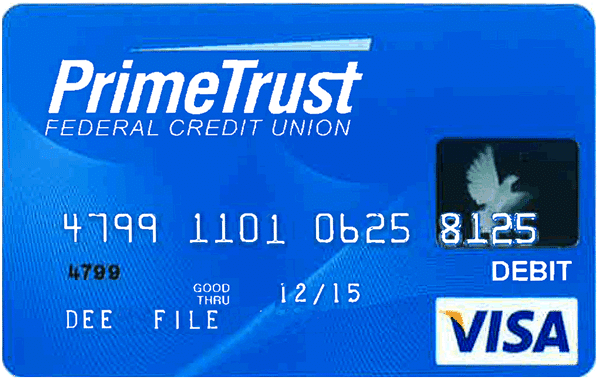

Blue Trust Premium Bank Credit Card

Fast online application Credit-building opportunitiesHow the Blue Trust Premium Bank Credit Card Works in Real Life

Once approved, users gain access to a modest credit limit—usually between $300 and $1,000.

This may not sound like much, but for someone dealing with unexpected expenses or needing to demonstrate responsible credit usage, it’s a meaningful start. Even better, that credit can be accessed quickly, often within 24 hours, making it an ideal solution for emergencies or short-term cash flow gaps.

The online dashboard is another practical feature that simplifies life. Through it, users can manage payments, view statements, and track their balance in real time. There’s no fancy app interface, but what you get is clean, efficient, and secure—exactly what you need when managing credit with discipline.

There’s also an emphasis on repayment flexibility. Users aren’t forced into rigid structures, which is crucial for people whose incomes may vary month to month. Whether you’re employed full-time or picking up gigs to get by, the card’s payment system gives you room to breathe.

And for those who are actively working on their credit score, the card reports monthly to all three major credit bureaus. That means every on-time payment counts—and over time, that consistency can raise your credit score significantly.

Main Benefits of the Blue Trust Premium Bank Credit Card

One of the most important benefits is the fast and accessible approval process. Unlike traditional credit cards that require excellent credit or even collateral, Blue Trust takes a more inclusive approach. Applicants are evaluated with broader criteria in mind, giving more people a fair shot.

Another key benefit is the lack of a security deposit. For consumers who can’t afford to lock up hundreds of dollars just to access credit, this is a game-changer. It makes the card available to a broader audience and lowers the barrier to entry.

Then there’s the digital accessibility. Everything is handled online, from application to account management.

That convenience is crucial in today’s world, where most people manage their finances from their phones or laptops.

Also worth noting is the flexibility around repayments. If you hit a tight month, you’re not automatically penalized with harsh fees or immediate drops in your credit limit. As long as you communicate and stay within guidelines, the system gives you a chance to recover and stay on track.

Lastly, the ongoing credit reporting gives users the ability to build their score gradually. This can open the door to better financial products in the future, such as personal loans, auto financing, or premium credit cards.

You will be redirected.

Cons of the Blue Trust Premium Bank Credit Card

Despite all these positives, the card isn’t perfect—and it’s important to understand the trade-offs.

The first and most obvious drawback is the cost. The APR is on the higher end, and there’s typically a monthly maintenance fee attached. These fees can eat into your budget if you’re not careful, especially if you carry a balance.

There are also no rewards, no cash back, and no points. For people accustomed to maximizing their spending through perks, this card offers none of those extras. It’s purely a credit-building tool.

The credit limit is also quite low in the beginning. While this makes sense for a card aimed at rebuilding credit, it does limit your purchasing power. If you’re looking to finance a major purchase, this isn’t the card for you.

Lastly, there’s limited room for upgrade. Unlike some credit cards that automatically review your progress and raise your limit or lower your fees, this one doesn’t offer much in the way of evolving benefits.

APR and Fees

The APR for the Blue Trust Premium Bank Credit Card typically ranges from 29.99% to 35.99%, depending on your creditworthiness.

That’s significantly higher than many mainstream cards, and it’s something to keep in mind if you plan on carrying a balance.

In addition, there’s usually a monthly maintenance fee of $10 to $15, which adds up over time. There may also be setup fees when you first open the account, although these vary based on your approval terms.

Late payment fees and returned payment penalties are also part of the structure, so it’s crucial to stay on top of due dates. Setting up automatic payments through the dashboard can help prevent any unexpected charges.

How to Apply for the Blue Trust Premium Bank Credit Card

To apply for the Blue Trust Premium Bank Credit Card:

- Visit the official Blue Trust Bank website.

- Click on the credit card section and select the “Premium” option.

- Fill out the application form with your personal and financial details.

- Submit your application and wait for the instant decision.

- If approved, review the terms, accept the offer, and access your credit line online.